How Can Financial Forecasting Help You?

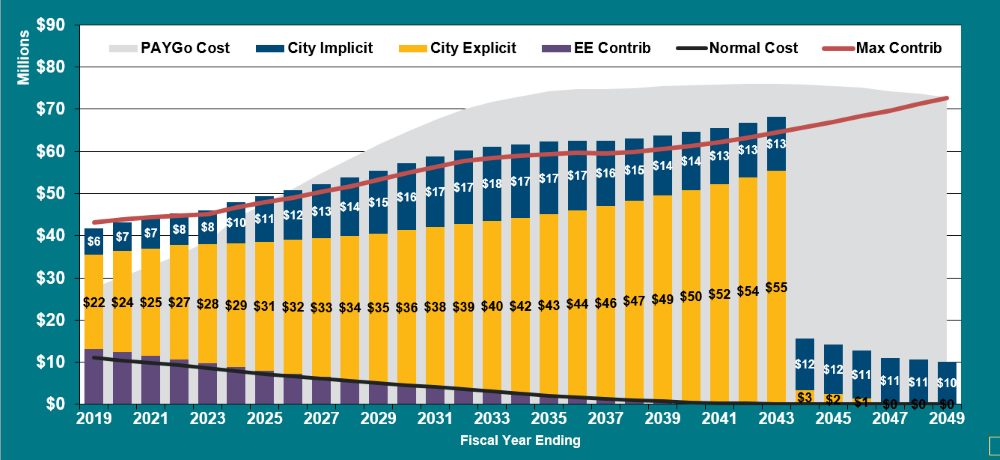

Financial forecasting is key for well-managed plans. We prepare financial forecasts by stress testing with H-Scan, our sophisticated customized interactive modeling tool. Stress-testing is the linchpin of our financial forecasts, whether the forecasts are for understanding special situations, producing accounting reports, or developing funding policies. Financial forecasting helps you:

- Estimate healthcare spending

- Set budgets

- Identify potential problems

- Predict the impact of changes in contributions, benefits or eligibility

Why Do You Need Cheiron’s Help in Preparing Accounting Reports?

Whether you’re a public plan, a multiemployer plan, or a single-employer plan, you can trust us to prepare accounting reports to meet reporting requirements. We ensure your accounting reports satisfy your requirements for:

- Calculating your retiree health liabilities to meet FASB ASC 965

- Computing your OPEB liabilities to comply with GASB Statements No. 74 and 75 disclosures in your comprehensive annual financial reports

- Projecting your retiree health or other post-employment benefits (OPEB) for disclosures in corporate annual financial statements under FASB ASC 715 and 958

How Can Financial Forecasting Shape Funding Policies?

Stress testing with H-Scan helps us show you the risks your plan faces and:

- Track how your spending compares with trends

- Show you the effect of alternative funding policies under different economic forecasts

- Examine how different discount rates, benefits or eligibility requirements can affect your accounting disclosures