Ensure Stable Contributions and Retirement Security

With Adjustable Pension Plans

Are Adjustable Pension Plans Right for You?

- Expect stable annual contributions because you share investment risks with covered employees

- Offer lifelong retirement security to your participants

- Receive expert advice from Cheiron. We helped design these plans and set up the first plan in 2012. We understand their optional features better than any other actuarial consulting firm.

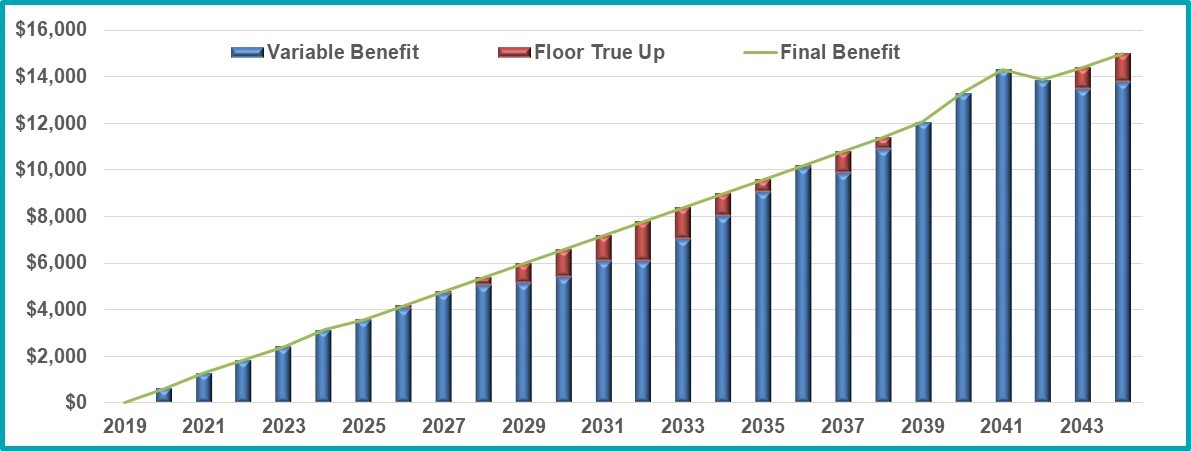

Sample Benefit Accruals

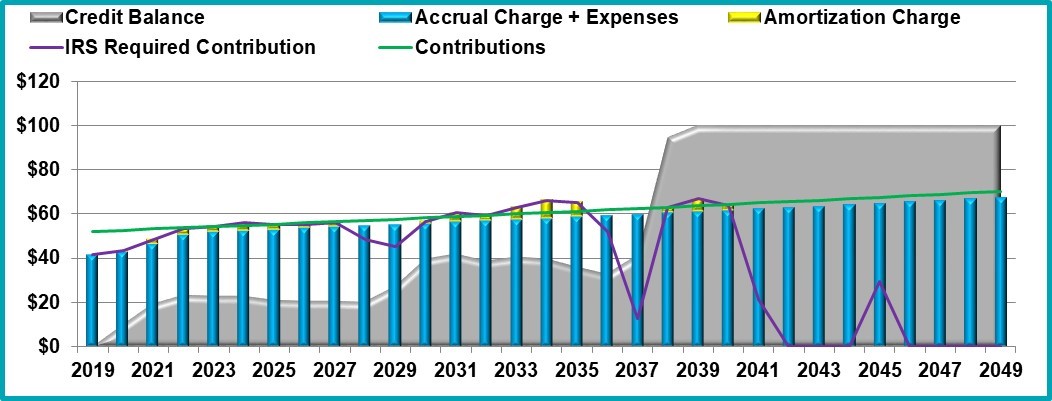

Sample Plan Sponsor Contributions

How do Adjustable Pension Plans Work?

- Balance the investment risks with participants and adjust the accrued benefit or future benefit accruals based on the plan’s investment performance

- Contribute a predetermined amount annually

- Secure a fixed pension for participants at retirement, or let retiree benefits vary with investment performance

What are the Advantages of Adjustable Pension Plans for Plan Sponsors?

- Share investment risks with participants

- Budget easier because you contribute a fixed amount annually to the plans

- Protect the funding of the pension plans. The plans are more likely to remain well funded because of the reduced risk.

- Avoid regulatory uncertainties because the Internal Revenue Service has already approved adjustable pension plan designs

- Attract and retain talented employees because the plan enhances retirement security

For corporations or single-employer plans:

- Reduce the risk of paying steep PBGC variable premiums on top of the flat premium of $111 per participant. Fully-funded plans can avoid the variable premium of $52 per $1,000 of unfunded vested benefits in 2026.

For multiemployer pension plans:

- A higher likelihood of being fully funded means you can avoid withdrawal liability.

What are the Advantages of Adjustable Pension Plans for Participants?

- Receive a monthly pension for life. Participants needn’t worry about outliving their retirement savings.

- Protected funding levels because of the lower risk

- Pooled and professionally managed investments and more conservative asset allocations. Unlike 401(k)-type plans, participants do not shoulder all the investment risks.