P-Scan, our interactive pension projection modeling tool, helps you conduct stress tests and make informed decisions by:

- Customizing the model to the objectives of your plan

- Illustrating in real time the contribution rates and funded status under various economic scenarios

- Developing policies to control financial risks

- Evaluating different funding policies

- Assessing the financial implications of proposed changes

- Demonstrating the impact of possible economic shocks on the plan

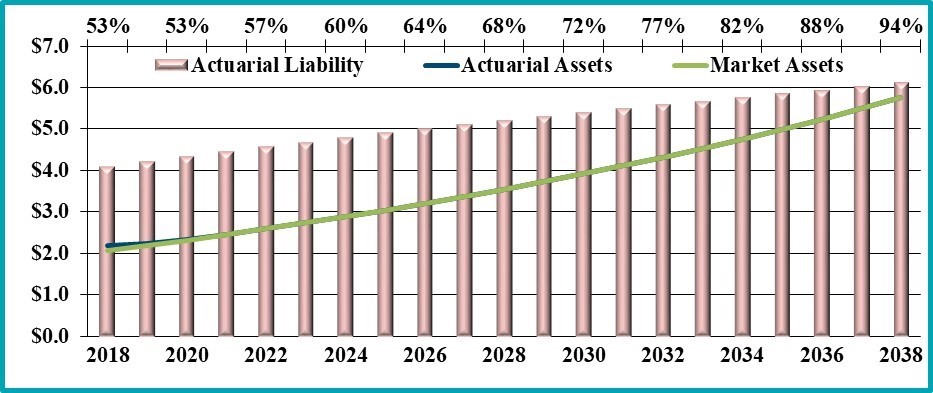

Assets and Liabilities

This is a sample P-Scan projection of the assets and liabilities of a public sector pension plan. The deterministic projection allows trustees to estimate a plan’s funded status under different scenarios by changing variables such as the expected investment returns and discount rates. This projection shows a plan that was 53% funded in 2018 and is projected to be almost fully funded by the end of the 20-year period if it meets all the assumptions.

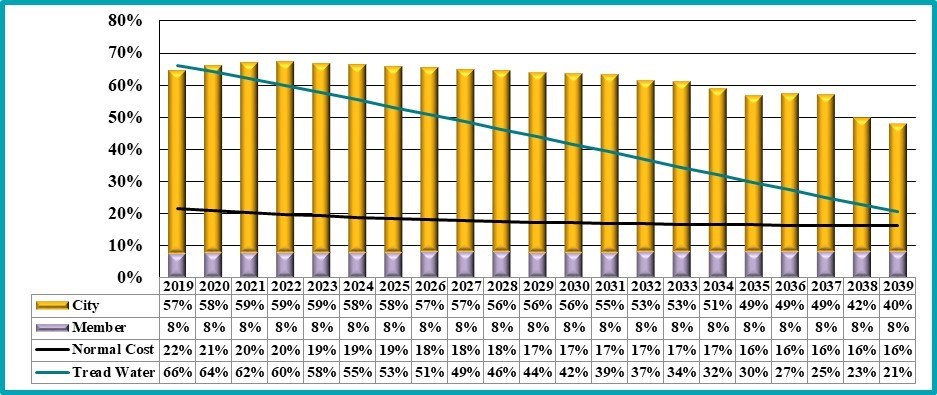

Contributions

This graph shows the projection of the plan’s contributions—both the city’s and member’s contribution rates as a percentage of pay; the normal cost or the cost of providing an additional year of benefit accruals; and the tread water rate or the minimum contribution needed to maintain the current funded status.