Get Real-Time Stress Testing Results

For Your Multiemployer Pension Plan

P-Scan, our interactive pension projection modeling tool, helps you conduct stress tests and make informed decisions by:

- Understanding the impact of investment risks

- Showing your plan’s projected zone status under the Pension Protection Act

- Monitoring the progress of your rehabilitation or funding improvement plan

- Demonstrating the effects of another Great Recession

- Projecting how your plan will fare as much as 30 years in the future

- Identifying in real time the impact of changes in contributions, discount rates, actuarial assumptions, and plan designs

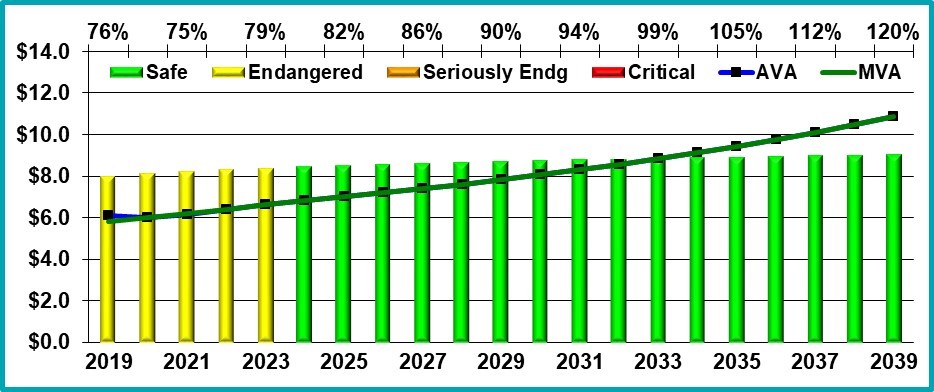

Projection of Zone Status

This is a sample P-Scan projection of a multiemployer plan’s funded status. The deterministic projection allows trustees to estimate a plan’s financial health under different scenarios by entering variables, such as expected investment returns. The graph shows the plan’s projected funding percentage, assets, liabilities, and status under the Pension Protection Act. This plan is Endangered but expects to emerge into the Safe zone in 2024.

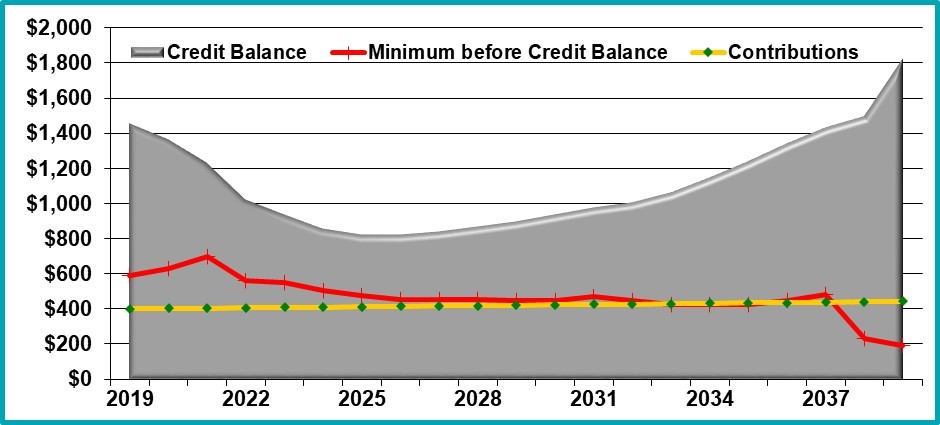

Credit Balance and Contributions

This graph shows projections of the Credit Balance, the Minimum Required Contribution before applying the Credit Balance, and the plan’s contributions. While the plan’s Credit Balance will decrease for a few years, it is expected to increase consistently after 2025 for the remainder of the projection.

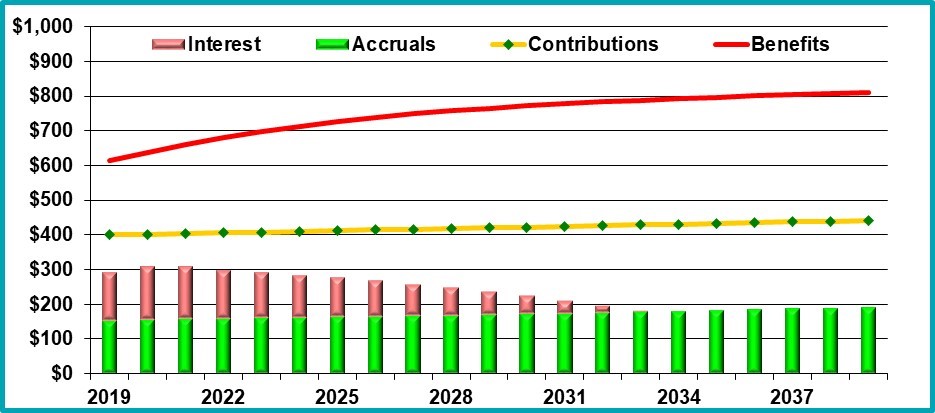

Cash Flows

This graph shows the projection of the plan’s contributions, benefits, accruals or the cost of benefits in a given year, and the interest on the unfunded liabilities. In mature plans, the annual benefit payments will exceed the annual contributions. Investment income or the sale of assets will have to make up the difference. It is also important to check that contributions are greater than the annual accruals and interest on the unfunded liabilities. If they are, the unfunded liabilities will be paid down unless the experience is worse than expected.