P-Scan, our interactive pension projection modeling tool, helps you conduct stress tests and make informed decisions by:

- Analyzing in real-time the trajectory of your plan’s funded status

- Conducting proactive pension finance and risk analysis

- Budgeting for short-term and long-term cash and FASB accounting requirements

- Understanding the impact of asset allocation changes and de-risking on funding and FASB accounting requirements

- Reviewing the impact of different funding strategies on your pension plan

- Ensuring that the future costs of your pension plan design fit your budget

- Analyzing the cost impact of changes in interest rates

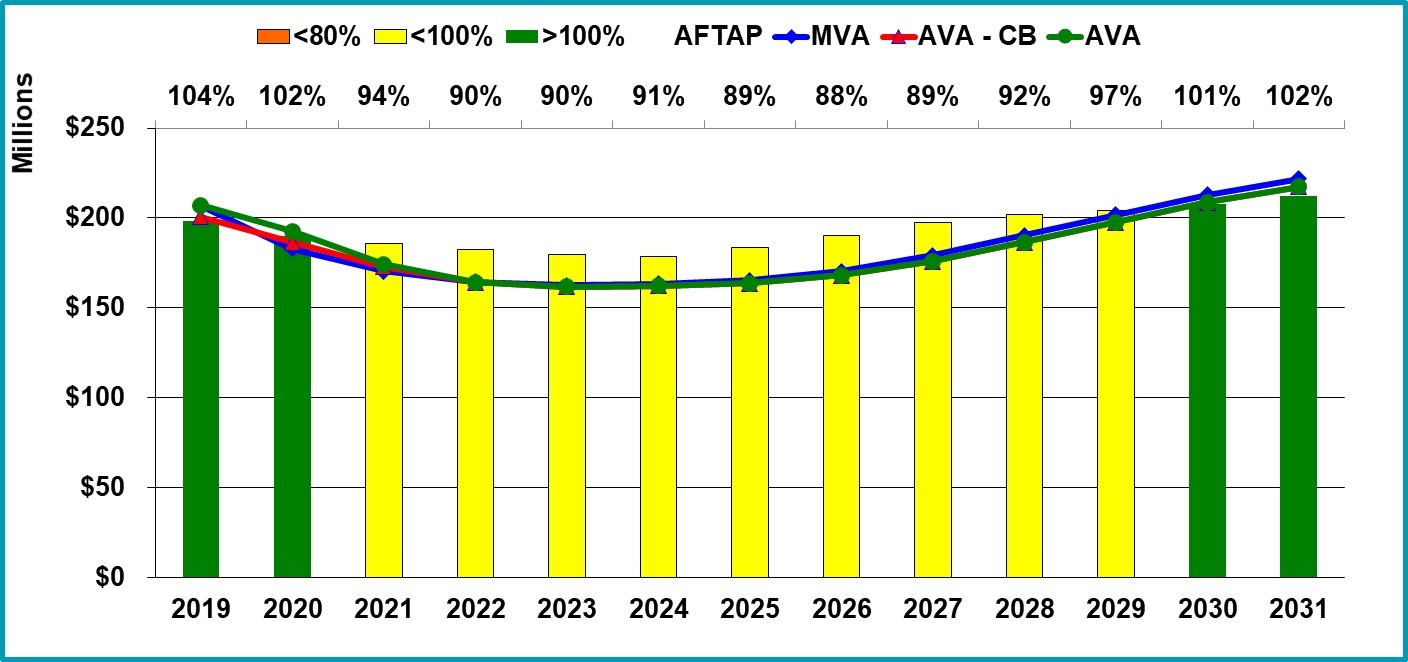

A Sample Projection of a Plan Sponsor’s Assets and Liabilities

This is a P-Scan projection of a single-employer plan’s liabilities and assets. Plan sponsors may estimate a plan’s financial health under different scenarios by tweaking variables such as expected investment returns and interest rates. The percentages are a ratio of the plan’s adjusted assets to liabilities or Adjusted Funding Target Attainment Percentage (AFTAP). The blue and green lines represent the Market Value of Assets and Actuarial Value of Assets. This plan expects its funding level to drop below 100% on an AFTAP basis, but become more than 100% funded on an AFTAP basis in 2030.

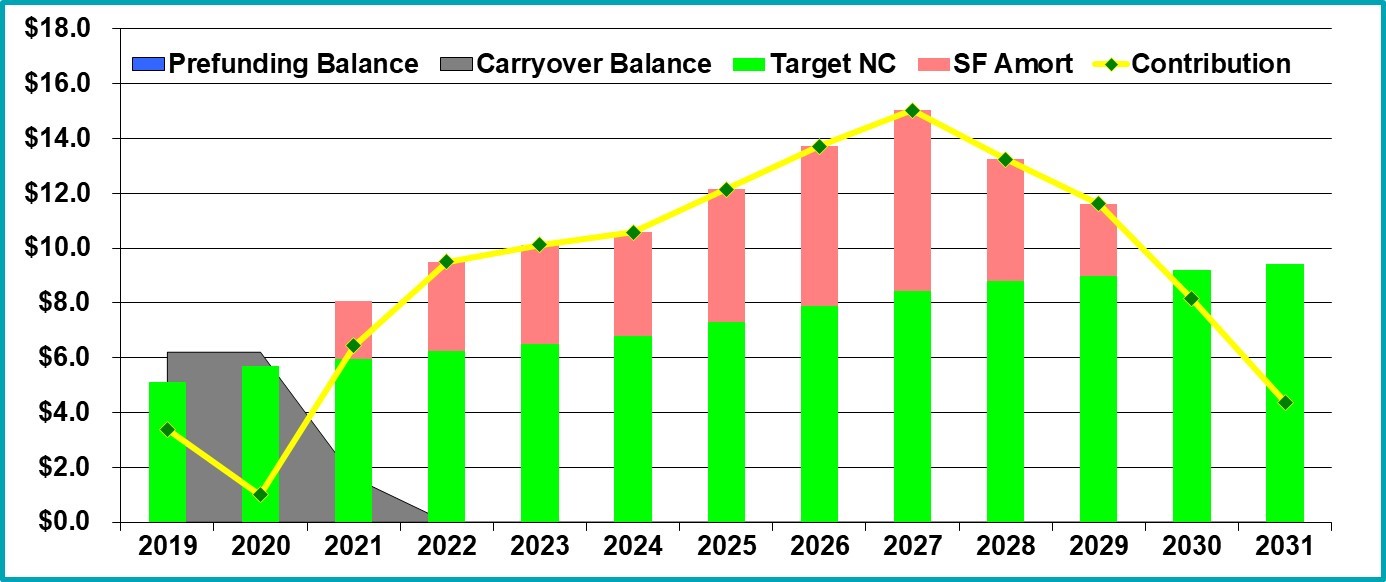

Credit Balance and Contributions

This graph shows the components of the plan’s Minimum Required Contribution consisting of the Carryover Balance, the Target Normal Cost, the Shortfall Amortization Charge, and the plan’s contributions. This plan does not have a Prefunding Balance. The graph shows that the plan will use the Carryover Balance to reduce the Minimum Required Contributions and the Carryover Balance will be exhausted after 3 years. For 2030 and 2031 the contributions are less than the Target Normal Cost. That’s because the plan’s Funding Percentage is projected to be more than 100%, and the Minimum Required Contribution is reduced by any assets exceeding the Funding Target.