Multiemployer Plan Pension Rescue Bill Proposed

Senator Sherrod Brown from Ohio has proposed the Butch Lewis Act of 2017 (S. 2147) to rescue multiemployer pension plans that are insolvent or classified as "critical and declining." The Butch Lewis Act of 2017 (the bill) establishes a new loan program to provide funds to these plans for the benefits of participants and beneficiaries in pay status.

General Idea

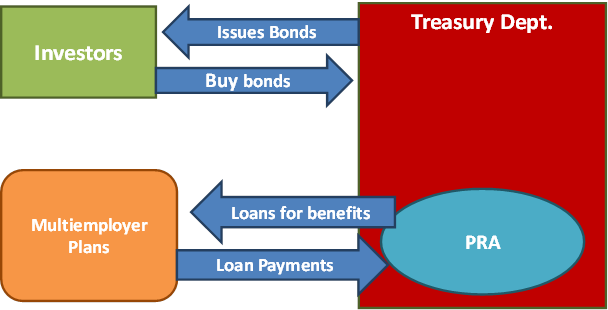

The bill creates a new agency within the Department of the Treasury called the Pension Rehabilitation Administration (PRA) to make loans to plans and to receive loan payments. The PRA would receive funding from government bonds. The general process works as follows:

From Government's Viewpoint

The loans allow plans to improve current cash flows and grow existing plan assets. A plan would receive the loan and be required to either purchase an annuity contract for benefits in pay status, or establish a bond portfolio that would match the anticipated payment stream for benefits in pay status. The plan would make interest payments on the loan until maturity. From a cash flow standpoint, the process swaps current cash outlays for later cash outlays that have the following impact:

From Plan's Viewpoint

Specific Details

PRA to Plan Loan Program

Eligible plans - multiemployer defined benefit plans that:

- are in critical and declining status, including any plan that received approval for a suspension of benefits under the Multiemployer Pension Reform Act of 2014 (MPRA), or

- are insolvent, if they became insolvent after December 16, 2014, and have not been terminated.

Loan Terms - the loan terms will need to provide:

- interest payments for 29 years (starting with date of the loan),

- final payment of interest and principal shall be due in the 30th year,

- as a condition, except for instances where suspended benefits must be restored, during the 30-year period the plan sponsor must stipulate that it will not increase benefits,

- for plans for which a suspension of benefits has been approved, the plan must reinstate all suspended benefits,

- during the loan period, plans may not allow any employer to reduce its contributions, or accept any collective bargaining agreement which provides for reduced contribution rates,

- the plan will comply with new reporting requirement under the bill (see below), and

- the plan and plan administrator will meet such other requirements as the Pension Rehabilitation Administration provides.

Loan Amount - the amount of the loan "shall be" the amount needed to provide benefits of participants and beneficiaries in pay status at the time the loan is made funded through either:

- the purchase of annuity contracts,

- implementing a cash matching portfolio, or a duration matching portfolio, consisting of investment grade fixed income investments which are tradeable in United States currency and are issued at fixed or zero coupon rates, or

- implementing another portfolio prescribed in regulations which has a similar risk profile and is equally protective of the interests of participants and beneficiaries.

For plans for which a suspension of benefits has been approved, the suspension of benefits will not be taken into account in applying, and the loan amount will be the amount sufficient to provide benefits of participants and beneficiaries of the plan in pay status at the time the loan is made, determined without regard to the suspension, including the retroactive payment of benefits which would otherwise have been payable during the period of the suspension.

Loan Application - In general, plans that want a loan will have to apply for it. The bill lists certain information and requirements for an application, and authorizes the Director of the Pension Rehabilitation Administration to request such other information as it requires. In general, the PRA has 90 days to approve or disapprove a loan application and is required to consult with the Department of Labor (DOL) and Pension Benefit Guaranty Corporation (PBGC). Application is mandatory for a plan with an approved suspension of benefits under a (yet to be provided) simplified application process.

Additional Provisions

Reporting to Treasury - the bill requires additional annual reporting by plans receiving a loan. There is a list of 17 items to be covered in a report, which is to be filed electronically. Treasury is required to share the information with the DOL and PBGC.

PBGC Assistance - not all plans will be able to repay a loan for the full amount of the current retired life liability. The bill provides for additional financial assistance by the PBGC for plans that apply for a loan and are projected to be insolvent during the 30-year period despite the receipt of the loan. PBGC financial assistance will not exceed the amount of the PBGC guarantee and only extend to retirees and terminated vested participants at the date of application. The amount of assistance is the minimum that, in combination with the loan, makes the plan solvent over the 30-year period.

|

If

you are interested in seeing how the bill will apply to your plan, please contact

us at 877-243-4766, ext. 1000. |

Cheiron is an actuarial consulting firm that provides actuarial and consulting advice. However, we are neither attorneys nor accountants. Accordingly, we do not provide legal services or tax advice.